When an insurer issues claim payments, the job isn’t always finished once the check clears. The recent Pennsylvania Superior Court decision in Spilled Milk, Inc. v. Nautilus Insurance Co. (Oct. 28, 2025), serves as a reminder that even well-intentioned payment handling can expose a carrier to breach of contract and bad faith allegations when the wrong party ends up with the funds.

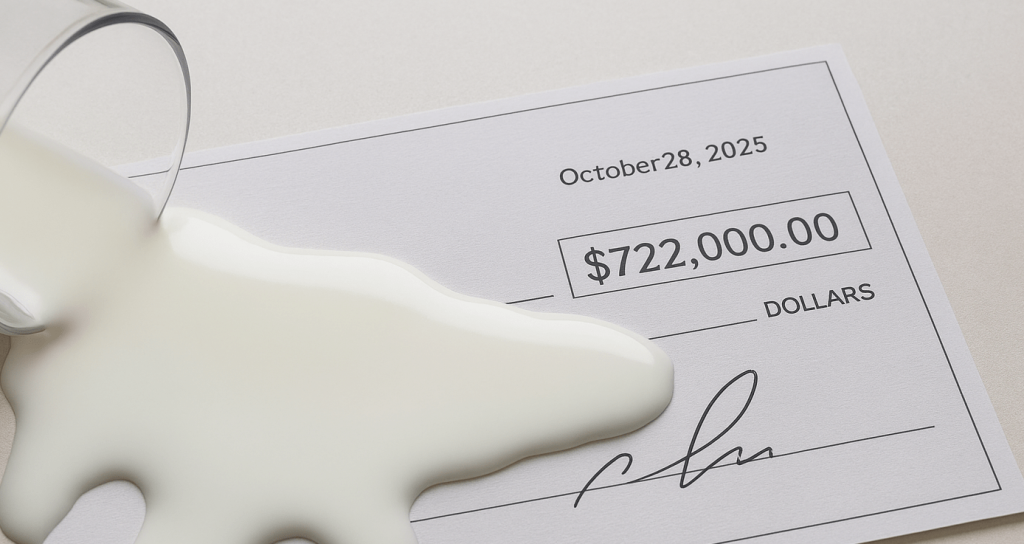

Spilled Milk, Inc. sustained an insured loss and hired Zenith Public Adjusters to handle its claim with Nautilus. The letter of representation instructed Nautilus to direct correspondence and checks to Zenith and to include “Zenith” as a payee on any drafts. Nautilus ultimately issued over $722,000 in settlement checks payable to “Spilled Milk, Inc. & Liberty Public Adjusters LLC.” Liberty, however, wasn’t the named public adjuster—though both entities were controlled by the same individual, Michael Shelly. Shelly pocketed the proceeds and was later criminally convicted. When Spilled Milk discovered what happened, it demanded that Nautilus reissue payment. Nautilus refused, reasoning that it had already “paid” the claim and could not be forced to pay twice for the same loss.

The trial court sided with Nautilus, finding that the insurer had fulfilled its contractual duty and that Spilled Milk bore the loss caused by its own agent’s misconduct. The Superior Court reversed. Accepting the complaint’s allegations as true, the appellate court concluded that Nautilus may have issued payment to an unauthorized entity and failed to follow the insured’s instructions.

That distinction—between a payment to an authorized agent and one to an unauthorized party—proved critical. The court emphasized that an insurer’s obligation isn’t discharged by paying the wrong recipient, even if done innocently. The opinion also reinstated Spilled Milk’s bad faith claim under Pennsylvania’s bad faith statute, holding that it was not “clear and free from doubt” that Nautilus had acted reasonably in denying the reissuance request.

Spilled Milk illustrates that “paid” doesn’t always mean “paid.” Issuing a check to the wrong entity can reopen coverage obligations and expose the insurer to allegations of breach and bad faith. In claims involving public adjusters, carriers should confirm payee authority in writing, document every authorization change, and, when in doubt, seek clarification directly from the insured before issuing payment.